Back to Page

Amazon Australia

Amazon Australia vs. USA/UK: Key Differences Sellers Need to Know

Amazon Australia vs. USA/UK: Key Differences Sellers Need to Know

Amazon Australia vs. USA/UK: Key Differences Sellers Need to Know

TL;DR

Amazon Australia is a fast-growing but less saturated marketplace, offering first-mover advantage compared to the highly competitive US and UK platforms.

Aussie shoppers value trust, local relevance, and sustainability over brand names—making localisation and strong listings essential for success.

FBA infrastructure in Australia is still developing, with slower delivery and higher shipping costs, often requiring hybrid fulfilment strategies.

Australia’s 10% GST, strict product safety rules, and different consumer expectations require sellers to adapt their pricing, compliance, and messaging.

Advertising costs are lower on Amazon AU due to less competition, allowing sellers to test and scale with smaller budgets.

Product trends in AU focus on eco-friendly goods, Australian-made items, and lifestyle-specific categories like outdoor gear, wellness, and pet care.

Amazon sellers generated over $100 million in export sales from Australia last year, yet many still treat Amazon AU like a mini version of the US or UK marketplaces—and that’s where things go wrong.

While the global Amazon model looks similar on the surface, each region operates with different customer behaviors, fee structures, competition levels, and growth opportunities. What works in the Amazon Australia vs US—where the market is mature, highly competitive, and saturated—won’t necessarily apply to Australia, which is still developing and full of untapped potential.

If you're planning to expand to Amazon Australia or trying to decide between AU, UK, or US, it’s important to understand the key differences that shape strategy and sales performance.

In this blog, we’ll break down everything from market maturity and buyer expectations to FBA logistics, local taxes, and what products are trending so you can make smarter, region-specific decisions and avoid common mistakes that cost sellers both time and money.

How is Amazon AU different from the USA and the UK?

Selling on Amazon Australia might look similar to the USA and UK on the surface, but the reality is quite different. From marketplace size and customer expectations to fulfilment infrastructure and compliance, the international Amazon selling differences are more important than most sellers realise.

#1 Marketplace size and maturity ( USA, UK, AU)

Amazon operates across all three regions, but the Amazon marketplace comparison shows that the size, maturity, and seller opportunity vary widely—and the numbers prove it. Each marketplace presents a different landscape for sellers, from the scale of Amazon USA to the growing potential of Amazon Australia.

Amazon USA is the largest and most mature marketplace, generating over $500 billion in GMV (Gross Merchandise Value) in 2023 alone. With 9.7 million sellers and over 150 million Prime members, it's a high-volume but highly saturated space. Most categories are dominated by seasoned sellers, aggressive PPC bidding, and advanced brand strategies.

Amazon UK is smaller but well-established, with around 400,000 active sellers and over 15 million Prime users. The market is competitive but not as cutthroat as the US, and British consumers tend to favor fast delivery, VAT-compliant listings, and clear product information. In 2023, Amazon UK generated approximately £30 billion in sales.

Amazon Australia, by comparison, is still growing. It launched in 2017 and currently has around 100,000 active sellers, with fewer than 20% of them being local Australian brands. Yet, Aussie sellers generated over $100 million in export sales in 2023, and Amazon continues to invest in local fulfillment and FBA expansion—signaling strong future potential.

Bottom line: the US offers scale, the UK offers maturity, and Amazon AU offers opportunity for first-movers.

#2 Customer behaviour and expectations

Australian Amazon customers shop differently compared to their US and UK counterparts. One of the biggest differences? Trust and convenience still matter more than brand recognition. Aussie shoppers are slower to adopt new sellers and often prefer products with clear value, fast delivery, and strong reviews—even if it’s from a lesser-known brand.

While US and UK buyers are used to aggressive deals, bundles, and instant shipping, Amazon Australia customers are still building trust in the platform. That means they’re more likely to research thoroughly, compare listings, and read reviews before purchasing.

Product listings also need to reflect local tone and expectations. Terms like “nappy bag” instead of “diaper bag” or showing measurements in centimetres and litres instead of inches and gallons can make a real difference in conversions.

Another key point—Australian buyers are highly conscious of sustainability and shopping local, so products labelled “eco-friendly,” “Made in Australia,” or “BPA-free” often get more attention. Understanding these habits helps sellers tailor listings and marketing for the Aussie market—rather than blindly copying what works overseas.

#3 Fulfilment options and logistics

One of the biggest differences sellers notice between Amazon Australia and its US/UK counterparts is how fulfilment works. While Amazon FBA is well-established in the US and UK with dozens of fulfilment centres and seamless logistics, Australia is still catching up.

Aspect | Amazon Australia | Amazon USA | Amazon UK |

Number of fulfilment centres | Limited (mostly in NSW & VIC) | Extensive (100+ centres across multiple states) | Well-established network across the UK |

FBA coverage | Limited regional coverage | Nationwide, including rural areas | Nationwide, faster rural delivery than AU |

Delivery speed (Prime) | Mostly 2–5 days, same-day in select metro areas | Same-day/next-day in most major cities | One-day Prime shipping standard in many areas |

3PL usage | Commonly used alongside FBA for better coverage | Optional, as Amazon’s network is strong | Optional, mostly used for overflow or FBM orders |

Multi-channel fulfilment | Limited support | Fully integrated with other platforms | Integrated with major e-commerce tools |

Shipping costs | Higher due to long distances and low volume | Competitive rates due to volume and scale | Moderate, with many low-cost courier options |

Restock lead time | Longer (must plan ahead 4–6 weeks) | Shorter (faster inbound and processing) | Relatively fast restock turnaround |

#4 Fees, taxes, and regulations

Selling on Amazon Australia comes with a few financial and compliance quirks that are very different from the US and UK.

First, the GST (Goods and Services Tax) is a big one. In Australia, most products are subject to a 10% GST, and Amazon automatically collects this on behalf of sellers. If you're selling as a business and your annual turnover exceeds AUD $75,000, you're required to register for GST and include it in your pricing.

This is unlike the US, where sales tax varies by state, or the UK, which follows a VAT model. When it comes to selling fees, Australia’s FBA fees are generally higher per unit compared to the US due to lower order volumes and higher logistics costs. That said, referral fees remain consistent across most categories.

Regulation-wise, Australia also has stricter rules on product safety and labelling—especially for food, supplements, cosmetics, and baby items. You may need TGA registration or meet Australian standards to sell legally. Thus, selling in Australia means planning for local compliance and pricing strategically to maintain margins.

#5 Advertising and competition

One of the biggest differences between Amazon Australia and its US or UK counterparts is the level of competition—and how that affects advertising.

In the US and UK, advertising is intense and expensive. You're often competing against well-established brands with deep pockets, aggressive PPC strategies, and highly optimised listings. Ad costs are higher, clicks are harder to win, and it takes real effort to stand out.

In contrast, Amazon Australia offers a less saturated ad space. Many categories have fewer active sellers running Amazon Sponsored ads or Sponsored Brands campaigns, which means lower CPCs (cost-per-click) and more room to test and scale with a smaller budget.

However, lower competition doesn’t mean you should ignore ad strategy. With fewer ads, strong campaigns stand out more—and you have a better chance of ranking organically with smart targeting.

When selling on Amazon AU vs US, it’s important to recognise that while the US requires aggressive bidding to stay visible, Amazon AU rewards efficient, well-targeted campaigns that can deliver strong results with lower ad spend.

Feature | Amazon USA | Amazon UK | Amazon Australia |

CPC costs | High | Moderate to High | Low to Moderate |

Ad competition | Very High | High | Low |

Brand dominance | Strong, established brands | Mix of big and small brands | Many small/medium brands |

Organic ranking difficulty | Difficult | Moderate | Easier |

Ad strategy needed | Aggressive | Strategic | Efficient but consistent |

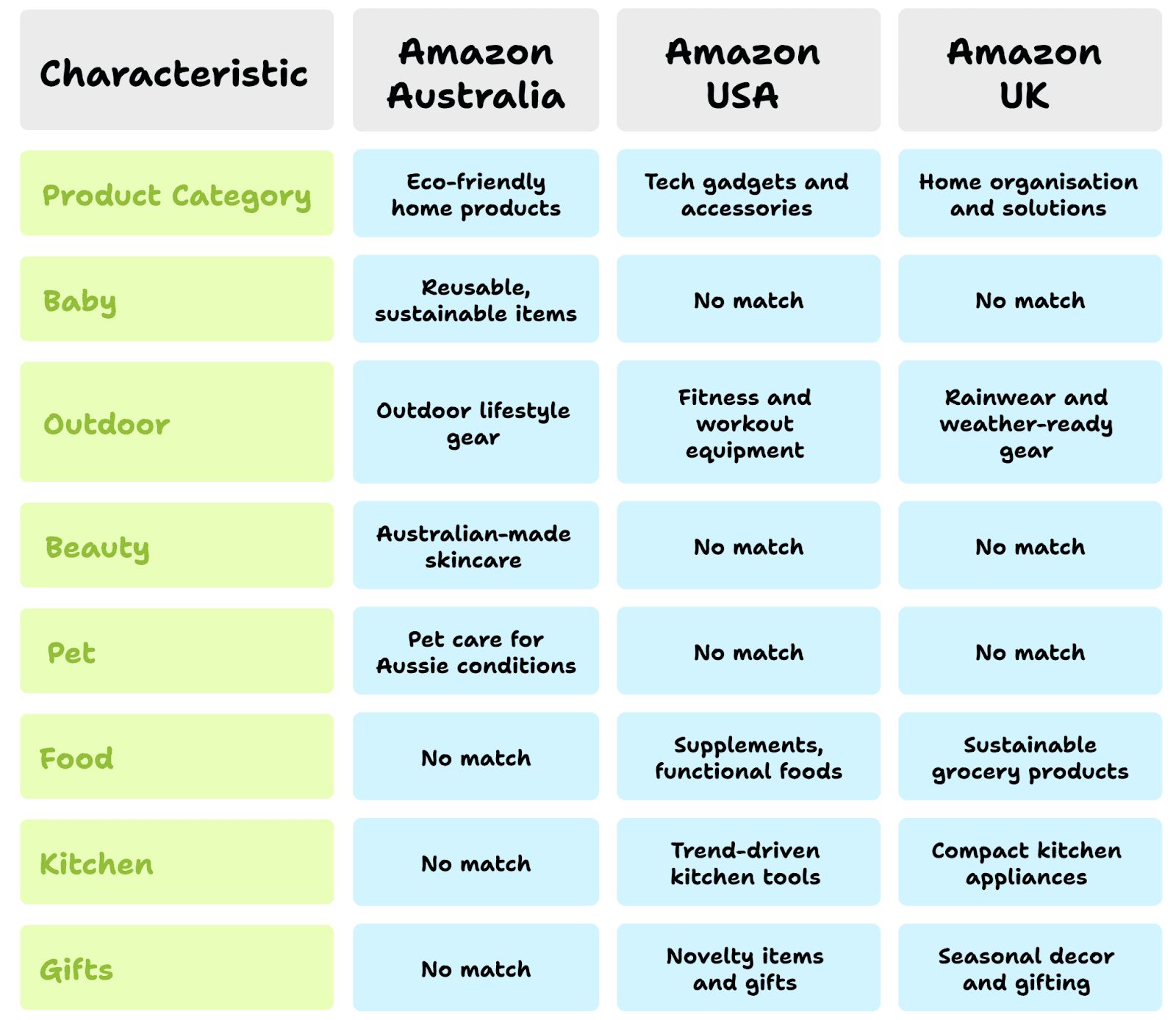

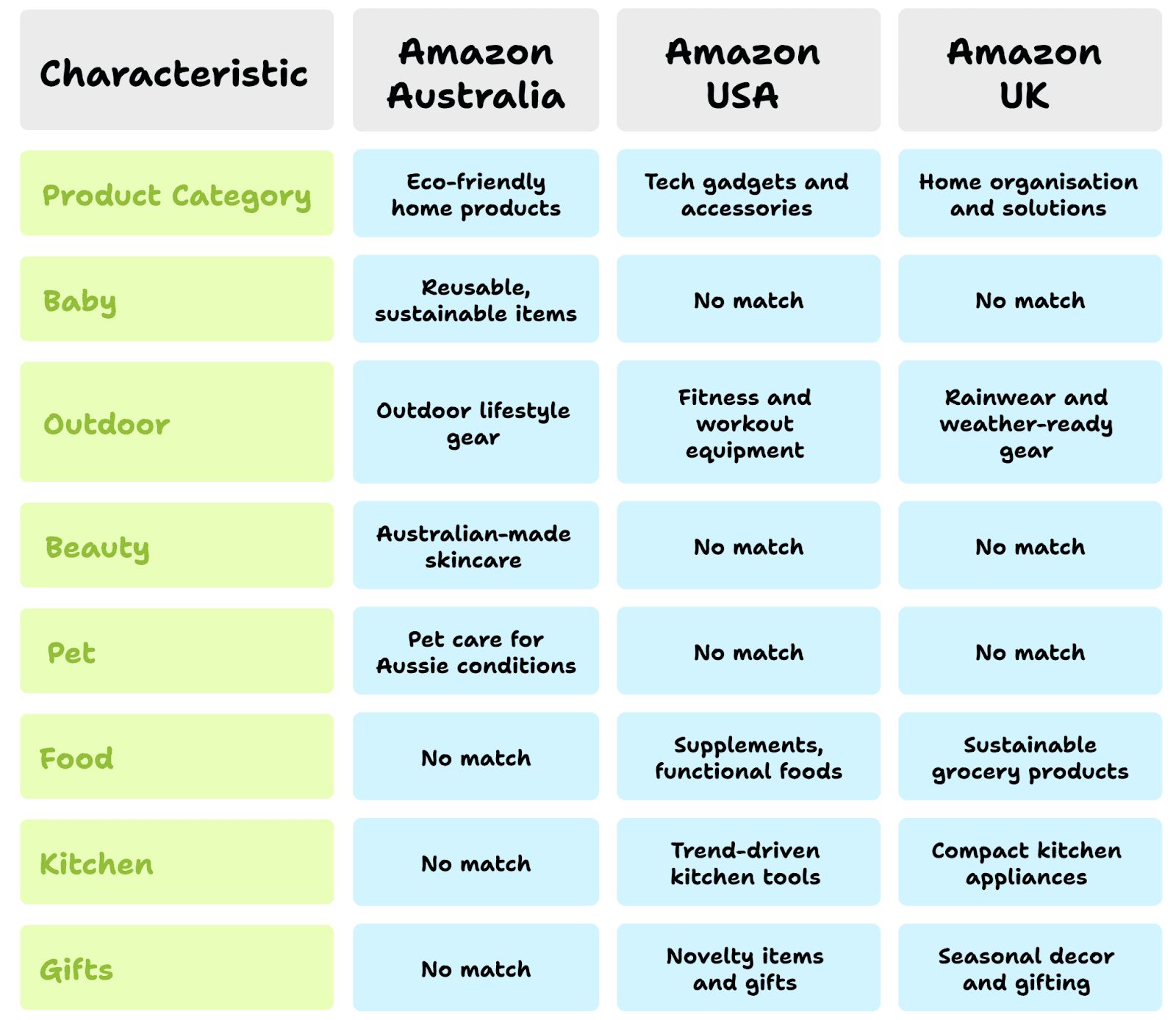

#6 Product trends and opportunities

Amazon Australia is still in its growth phase, which means it's less saturated—but also less predictable—than its US and UK counterparts. When looking at Amazon UK vs Australia, it's clear that while the UK offers a more mature and stable market, Australia presents a unique window for sellers who can spot local trends early and act fast.

In the US and UK, many niches are overcrowded, with thousands of sellers competing on price and reviews. On Amazon AU, there’s more room to breathe. Categories like eco-friendly home goods, pet care, Australian-made skincare, home office products, and outdoor gear are gaining strong traction but still have limited competition.

Local preferences also differ. Aussies tend to support sustainable, locally made, and practical products—especially those suited to the climate and lifestyle. Think mosquito nets, water-saving tools, beach accessories, or baby products with natural ingredients. Because shoppers in Australia are still warming up to Amazon, trust plays a bigger role. Listings with professional content, local language, and reliable FBA delivery have an advantage.

Here’s how product trends and niche opportunities vary by region:

Amazon Australia:

Eco-friendly home products

Reusable and sustainable baby items

Outdoor lifestyle gear (camping, beach, garden)

Australian-made skincare and wellness products

Pet care products tailored to Aussie conditions

Amazon USA:

Tech gadgets and accessories

Fitness and home workout equipment

Trend-driven kitchen tools

Supplements and functional foods

Novelty items and giftable products

Amazon UK:

Home organisation and small-space solutions

Rainwear and weather-ready gear

Sustainable grocery and pantry products

Compact kitchen appliances

Seasonal decor and gifting items

Final thoughts

Expanding to Amazon Australia isn’t just a matter of copying what works in the US or UK—it requires a region-specific strategy. With lower competition, rising demand, and room for niche products, Amazon AU presents a real growth opportunity for sellers who understand the local landscape.

From fulfilment limitations and GST compliance to unique customer behavior and product trends, the international Amazon selling differences matter more than ever. Success on Amazon AU comes down to timing, localisation, and strategic execution.

Whether you’re new to the market or looking to optimise your current presence, working with an experienced Amazon consultant can help you avoid missteps, adapt faster, and unlock growth. Need help navigating Amazon Australia? Amazon consultants are here to guide your global strategy—one marketplace at a time.

TL;DR

Amazon Australia is a fast-growing but less saturated marketplace, offering first-mover advantage compared to the highly competitive US and UK platforms.

Aussie shoppers value trust, local relevance, and sustainability over brand names—making localisation and strong listings essential for success.

FBA infrastructure in Australia is still developing, with slower delivery and higher shipping costs, often requiring hybrid fulfilment strategies.

Australia’s 10% GST, strict product safety rules, and different consumer expectations require sellers to adapt their pricing, compliance, and messaging.

Advertising costs are lower on Amazon AU due to less competition, allowing sellers to test and scale with smaller budgets.

Product trends in AU focus on eco-friendly goods, Australian-made items, and lifestyle-specific categories like outdoor gear, wellness, and pet care.

Amazon sellers generated over $100 million in export sales from Australia last year, yet many still treat Amazon AU like a mini version of the US or UK marketplaces—and that’s where things go wrong.

While the global Amazon model looks similar on the surface, each region operates with different customer behaviors, fee structures, competition levels, and growth opportunities. What works in the Amazon Australia vs US—where the market is mature, highly competitive, and saturated—won’t necessarily apply to Australia, which is still developing and full of untapped potential.

If you're planning to expand to Amazon Australia or trying to decide between AU, UK, or US, it’s important to understand the key differences that shape strategy and sales performance.

In this blog, we’ll break down everything from market maturity and buyer expectations to FBA logistics, local taxes, and what products are trending so you can make smarter, region-specific decisions and avoid common mistakes that cost sellers both time and money.

How is Amazon AU different from the USA and the UK?

Selling on Amazon Australia might look similar to the USA and UK on the surface, but the reality is quite different. From marketplace size and customer expectations to fulfilment infrastructure and compliance, the international Amazon selling differences are more important than most sellers realise.

#1 Marketplace size and maturity ( USA, UK, AU)

Amazon operates across all three regions, but the Amazon marketplace comparison shows that the size, maturity, and seller opportunity vary widely—and the numbers prove it. Each marketplace presents a different landscape for sellers, from the scale of Amazon USA to the growing potential of Amazon Australia.

Amazon USA is the largest and most mature marketplace, generating over $500 billion in GMV (Gross Merchandise Value) in 2023 alone. With 9.7 million sellers and over 150 million Prime members, it's a high-volume but highly saturated space. Most categories are dominated by seasoned sellers, aggressive PPC bidding, and advanced brand strategies.

Amazon UK is smaller but well-established, with around 400,000 active sellers and over 15 million Prime users. The market is competitive but not as cutthroat as the US, and British consumers tend to favor fast delivery, VAT-compliant listings, and clear product information. In 2023, Amazon UK generated approximately £30 billion in sales.

Amazon Australia, by comparison, is still growing. It launched in 2017 and currently has around 100,000 active sellers, with fewer than 20% of them being local Australian brands. Yet, Aussie sellers generated over $100 million in export sales in 2023, and Amazon continues to invest in local fulfillment and FBA expansion—signaling strong future potential.

Bottom line: the US offers scale, the UK offers maturity, and Amazon AU offers opportunity for first-movers.

#2 Customer behaviour and expectations

Australian Amazon customers shop differently compared to their US and UK counterparts. One of the biggest differences? Trust and convenience still matter more than brand recognition. Aussie shoppers are slower to adopt new sellers and often prefer products with clear value, fast delivery, and strong reviews—even if it’s from a lesser-known brand.

While US and UK buyers are used to aggressive deals, bundles, and instant shipping, Amazon Australia customers are still building trust in the platform. That means they’re more likely to research thoroughly, compare listings, and read reviews before purchasing.

Product listings also need to reflect local tone and expectations. Terms like “nappy bag” instead of “diaper bag” or showing measurements in centimetres and litres instead of inches and gallons can make a real difference in conversions.

Another key point—Australian buyers are highly conscious of sustainability and shopping local, so products labelled “eco-friendly,” “Made in Australia,” or “BPA-free” often get more attention. Understanding these habits helps sellers tailor listings and marketing for the Aussie market—rather than blindly copying what works overseas.

#3 Fulfilment options and logistics

One of the biggest differences sellers notice between Amazon Australia and its US/UK counterparts is how fulfilment works. While Amazon FBA is well-established in the US and UK with dozens of fulfilment centres and seamless logistics, Australia is still catching up.

Aspect | Amazon Australia | Amazon USA | Amazon UK |

Number of fulfilment centres | Limited (mostly in NSW & VIC) | Extensive (100+ centres across multiple states) | Well-established network across the UK |

FBA coverage | Limited regional coverage | Nationwide, including rural areas | Nationwide, faster rural delivery than AU |

Delivery speed (Prime) | Mostly 2–5 days, same-day in select metro areas | Same-day/next-day in most major cities | One-day Prime shipping standard in many areas |

3PL usage | Commonly used alongside FBA for better coverage | Optional, as Amazon’s network is strong | Optional, mostly used for overflow or FBM orders |

Multi-channel fulfilment | Limited support | Fully integrated with other platforms | Integrated with major e-commerce tools |

Shipping costs | Higher due to long distances and low volume | Competitive rates due to volume and scale | Moderate, with many low-cost courier options |

Restock lead time | Longer (must plan ahead 4–6 weeks) | Shorter (faster inbound and processing) | Relatively fast restock turnaround |

#4 Fees, taxes, and regulations

Selling on Amazon Australia comes with a few financial and compliance quirks that are very different from the US and UK.

First, the GST (Goods and Services Tax) is a big one. In Australia, most products are subject to a 10% GST, and Amazon automatically collects this on behalf of sellers. If you're selling as a business and your annual turnover exceeds AUD $75,000, you're required to register for GST and include it in your pricing.

This is unlike the US, where sales tax varies by state, or the UK, which follows a VAT model. When it comes to selling fees, Australia’s FBA fees are generally higher per unit compared to the US due to lower order volumes and higher logistics costs. That said, referral fees remain consistent across most categories.

Regulation-wise, Australia also has stricter rules on product safety and labelling—especially for food, supplements, cosmetics, and baby items. You may need TGA registration or meet Australian standards to sell legally. Thus, selling in Australia means planning for local compliance and pricing strategically to maintain margins.

#5 Advertising and competition

One of the biggest differences between Amazon Australia and its US or UK counterparts is the level of competition—and how that affects advertising.

In the US and UK, advertising is intense and expensive. You're often competing against well-established brands with deep pockets, aggressive PPC strategies, and highly optimised listings. Ad costs are higher, clicks are harder to win, and it takes real effort to stand out.

In contrast, Amazon Australia offers a less saturated ad space. Many categories have fewer active sellers running Amazon Sponsored ads or Sponsored Brands campaigns, which means lower CPCs (cost-per-click) and more room to test and scale with a smaller budget.

However, lower competition doesn’t mean you should ignore ad strategy. With fewer ads, strong campaigns stand out more—and you have a better chance of ranking organically with smart targeting.

When selling on Amazon AU vs US, it’s important to recognise that while the US requires aggressive bidding to stay visible, Amazon AU rewards efficient, well-targeted campaigns that can deliver strong results with lower ad spend.

Feature | Amazon USA | Amazon UK | Amazon Australia |

CPC costs | High | Moderate to High | Low to Moderate |

Ad competition | Very High | High | Low |

Brand dominance | Strong, established brands | Mix of big and small brands | Many small/medium brands |

Organic ranking difficulty | Difficult | Moderate | Easier |

Ad strategy needed | Aggressive | Strategic | Efficient but consistent |

#6 Product trends and opportunities

Amazon Australia is still in its growth phase, which means it's less saturated—but also less predictable—than its US and UK counterparts. When looking at Amazon UK vs Australia, it's clear that while the UK offers a more mature and stable market, Australia presents a unique window for sellers who can spot local trends early and act fast.

In the US and UK, many niches are overcrowded, with thousands of sellers competing on price and reviews. On Amazon AU, there’s more room to breathe. Categories like eco-friendly home goods, pet care, Australian-made skincare, home office products, and outdoor gear are gaining strong traction but still have limited competition.

Local preferences also differ. Aussies tend to support sustainable, locally made, and practical products—especially those suited to the climate and lifestyle. Think mosquito nets, water-saving tools, beach accessories, or baby products with natural ingredients. Because shoppers in Australia are still warming up to Amazon, trust plays a bigger role. Listings with professional content, local language, and reliable FBA delivery have an advantage.

Here’s how product trends and niche opportunities vary by region:

Amazon Australia:

Eco-friendly home products

Reusable and sustainable baby items

Outdoor lifestyle gear (camping, beach, garden)

Australian-made skincare and wellness products

Pet care products tailored to Aussie conditions

Amazon USA:

Tech gadgets and accessories

Fitness and home workout equipment

Trend-driven kitchen tools

Supplements and functional foods

Novelty items and giftable products

Amazon UK:

Home organisation and small-space solutions

Rainwear and weather-ready gear

Sustainable grocery and pantry products

Compact kitchen appliances

Seasonal decor and gifting items

Final thoughts

Expanding to Amazon Australia isn’t just a matter of copying what works in the US or UK—it requires a region-specific strategy. With lower competition, rising demand, and room for niche products, Amazon AU presents a real growth opportunity for sellers who understand the local landscape.

From fulfilment limitations and GST compliance to unique customer behavior and product trends, the international Amazon selling differences matter more than ever. Success on Amazon AU comes down to timing, localisation, and strategic execution.

Whether you’re new to the market or looking to optimise your current presence, working with an experienced Amazon consultant can help you avoid missteps, adapt faster, and unlock growth. Need help navigating Amazon Australia? Amazon consultants are here to guide your global strategy—one marketplace at a time.

TL;DR

Amazon Australia is a fast-growing but less saturated marketplace, offering first-mover advantage compared to the highly competitive US and UK platforms.

Aussie shoppers value trust, local relevance, and sustainability over brand names—making localisation and strong listings essential for success.

FBA infrastructure in Australia is still developing, with slower delivery and higher shipping costs, often requiring hybrid fulfilment strategies.

Australia’s 10% GST, strict product safety rules, and different consumer expectations require sellers to adapt their pricing, compliance, and messaging.

Advertising costs are lower on Amazon AU due to less competition, allowing sellers to test and scale with smaller budgets.

Product trends in AU focus on eco-friendly goods, Australian-made items, and lifestyle-specific categories like outdoor gear, wellness, and pet care.

Amazon sellers generated over $100 million in export sales from Australia last year, yet many still treat Amazon AU like a mini version of the US or UK marketplaces—and that’s where things go wrong.

While the global Amazon model looks similar on the surface, each region operates with different customer behaviors, fee structures, competition levels, and growth opportunities. What works in the Amazon Australia vs US—where the market is mature, highly competitive, and saturated—won’t necessarily apply to Australia, which is still developing and full of untapped potential.

If you're planning to expand to Amazon Australia or trying to decide between AU, UK, or US, it’s important to understand the key differences that shape strategy and sales performance.

In this blog, we’ll break down everything from market maturity and buyer expectations to FBA logistics, local taxes, and what products are trending so you can make smarter, region-specific decisions and avoid common mistakes that cost sellers both time and money.

How is Amazon AU different from the USA and the UK?

Selling on Amazon Australia might look similar to the USA and UK on the surface, but the reality is quite different. From marketplace size and customer expectations to fulfilment infrastructure and compliance, the international Amazon selling differences are more important than most sellers realise.

#1 Marketplace size and maturity ( USA, UK, AU)

Amazon operates across all three regions, but the Amazon marketplace comparison shows that the size, maturity, and seller opportunity vary widely—and the numbers prove it. Each marketplace presents a different landscape for sellers, from the scale of Amazon USA to the growing potential of Amazon Australia.

Amazon USA is the largest and most mature marketplace, generating over $500 billion in GMV (Gross Merchandise Value) in 2023 alone. With 9.7 million sellers and over 150 million Prime members, it's a high-volume but highly saturated space. Most categories are dominated by seasoned sellers, aggressive PPC bidding, and advanced brand strategies.

Amazon UK is smaller but well-established, with around 400,000 active sellers and over 15 million Prime users. The market is competitive but not as cutthroat as the US, and British consumers tend to favor fast delivery, VAT-compliant listings, and clear product information. In 2023, Amazon UK generated approximately £30 billion in sales.

Amazon Australia, by comparison, is still growing. It launched in 2017 and currently has around 100,000 active sellers, with fewer than 20% of them being local Australian brands. Yet, Aussie sellers generated over $100 million in export sales in 2023, and Amazon continues to invest in local fulfillment and FBA expansion—signaling strong future potential.

Bottom line: the US offers scale, the UK offers maturity, and Amazon AU offers opportunity for first-movers.

#2 Customer behaviour and expectations

Australian Amazon customers shop differently compared to their US and UK counterparts. One of the biggest differences? Trust and convenience still matter more than brand recognition. Aussie shoppers are slower to adopt new sellers and often prefer products with clear value, fast delivery, and strong reviews—even if it’s from a lesser-known brand.

While US and UK buyers are used to aggressive deals, bundles, and instant shipping, Amazon Australia customers are still building trust in the platform. That means they’re more likely to research thoroughly, compare listings, and read reviews before purchasing.

Product listings also need to reflect local tone and expectations. Terms like “nappy bag” instead of “diaper bag” or showing measurements in centimetres and litres instead of inches and gallons can make a real difference in conversions.

Another key point—Australian buyers are highly conscious of sustainability and shopping local, so products labelled “eco-friendly,” “Made in Australia,” or “BPA-free” often get more attention. Understanding these habits helps sellers tailor listings and marketing for the Aussie market—rather than blindly copying what works overseas.

#3 Fulfilment options and logistics

One of the biggest differences sellers notice between Amazon Australia and its US/UK counterparts is how fulfilment works. While Amazon FBA is well-established in the US and UK with dozens of fulfilment centres and seamless logistics, Australia is still catching up.

Aspect | Amazon Australia | Amazon USA | Amazon UK |

Number of fulfilment centres | Limited (mostly in NSW & VIC) | Extensive (100+ centres across multiple states) | Well-established network across the UK |

FBA coverage | Limited regional coverage | Nationwide, including rural areas | Nationwide, faster rural delivery than AU |

Delivery speed (Prime) | Mostly 2–5 days, same-day in select metro areas | Same-day/next-day in most major cities | One-day Prime shipping standard in many areas |

3PL usage | Commonly used alongside FBA for better coverage | Optional, as Amazon’s network is strong | Optional, mostly used for overflow or FBM orders |

Multi-channel fulfilment | Limited support | Fully integrated with other platforms | Integrated with major e-commerce tools |

Shipping costs | Higher due to long distances and low volume | Competitive rates due to volume and scale | Moderate, with many low-cost courier options |

Restock lead time | Longer (must plan ahead 4–6 weeks) | Shorter (faster inbound and processing) | Relatively fast restock turnaround |

#4 Fees, taxes, and regulations

Selling on Amazon Australia comes with a few financial and compliance quirks that are very different from the US and UK.

First, the GST (Goods and Services Tax) is a big one. In Australia, most products are subject to a 10% GST, and Amazon automatically collects this on behalf of sellers. If you're selling as a business and your annual turnover exceeds AUD $75,000, you're required to register for GST and include it in your pricing.

This is unlike the US, where sales tax varies by state, or the UK, which follows a VAT model. When it comes to selling fees, Australia’s FBA fees are generally higher per unit compared to the US due to lower order volumes and higher logistics costs. That said, referral fees remain consistent across most categories.

Regulation-wise, Australia also has stricter rules on product safety and labelling—especially for food, supplements, cosmetics, and baby items. You may need TGA registration or meet Australian standards to sell legally. Thus, selling in Australia means planning for local compliance and pricing strategically to maintain margins.

#5 Advertising and competition

One of the biggest differences between Amazon Australia and its US or UK counterparts is the level of competition—and how that affects advertising.

In the US and UK, advertising is intense and expensive. You're often competing against well-established brands with deep pockets, aggressive PPC strategies, and highly optimised listings. Ad costs are higher, clicks are harder to win, and it takes real effort to stand out.

In contrast, Amazon Australia offers a less saturated ad space. Many categories have fewer active sellers running Amazon Sponsored ads or Sponsored Brands campaigns, which means lower CPCs (cost-per-click) and more room to test and scale with a smaller budget.

However, lower competition doesn’t mean you should ignore ad strategy. With fewer ads, strong campaigns stand out more—and you have a better chance of ranking organically with smart targeting.

When selling on Amazon AU vs US, it’s important to recognise that while the US requires aggressive bidding to stay visible, Amazon AU rewards efficient, well-targeted campaigns that can deliver strong results with lower ad spend.

Feature | Amazon USA | Amazon UK | Amazon Australia |

CPC costs | High | Moderate to High | Low to Moderate |

Ad competition | Very High | High | Low |

Brand dominance | Strong, established brands | Mix of big and small brands | Many small/medium brands |

Organic ranking difficulty | Difficult | Moderate | Easier |

Ad strategy needed | Aggressive | Strategic | Efficient but consistent |

#6 Product trends and opportunities

Amazon Australia is still in its growth phase, which means it's less saturated—but also less predictable—than its US and UK counterparts. When looking at Amazon UK vs Australia, it's clear that while the UK offers a more mature and stable market, Australia presents a unique window for sellers who can spot local trends early and act fast.

In the US and UK, many niches are overcrowded, with thousands of sellers competing on price and reviews. On Amazon AU, there’s more room to breathe. Categories like eco-friendly home goods, pet care, Australian-made skincare, home office products, and outdoor gear are gaining strong traction but still have limited competition.

Local preferences also differ. Aussies tend to support sustainable, locally made, and practical products—especially those suited to the climate and lifestyle. Think mosquito nets, water-saving tools, beach accessories, or baby products with natural ingredients. Because shoppers in Australia are still warming up to Amazon, trust plays a bigger role. Listings with professional content, local language, and reliable FBA delivery have an advantage.

Here’s how product trends and niche opportunities vary by region:

Amazon Australia:

Eco-friendly home products

Reusable and sustainable baby items

Outdoor lifestyle gear (camping, beach, garden)

Australian-made skincare and wellness products

Pet care products tailored to Aussie conditions

Amazon USA:

Tech gadgets and accessories

Fitness and home workout equipment

Trend-driven kitchen tools

Supplements and functional foods

Novelty items and giftable products

Amazon UK:

Home organisation and small-space solutions

Rainwear and weather-ready gear

Sustainable grocery and pantry products

Compact kitchen appliances

Seasonal decor and gifting items

Final thoughts

Expanding to Amazon Australia isn’t just a matter of copying what works in the US or UK—it requires a region-specific strategy. With lower competition, rising demand, and room for niche products, Amazon AU presents a real growth opportunity for sellers who understand the local landscape.

From fulfilment limitations and GST compliance to unique customer behavior and product trends, the international Amazon selling differences matter more than ever. Success on Amazon AU comes down to timing, localisation, and strategic execution.

Whether you’re new to the market or looking to optimise your current presence, working with an experienced Amazon consultant can help you avoid missteps, adapt faster, and unlock growth. Need help navigating Amazon Australia? Amazon consultants are here to guide your global strategy—one marketplace at a time.